Is Google’s ‘Site Diversity’ Policy Hammering Your Bank’s Website?

Let’s get one thing straight: Google is not a democracy.

In fact, it is fair to say that it has, in a bit over 20 years, become a major societal force that operates as it deems best with little opportunity for commentary on specific movements.

“Nobody governs Google,” says Michael Bertini. “They are in total control.” Bertini is Senior Director, iQuanti, and a veteran SEO expert who writes frequently for The Financial Brand.

Cruise the websites, blogs and other resources maintained by search engine optimization experts and you find a long history that can be summarized this way: 1. Google changes the rules. 2. Many website operators and their advisors have little to no idea how it will affect their traffic and how they will have to change. 3. Lots of cross talk goes on. 4. Enterprising people do some testing. 5. Opinions are exchanged. 6. Eventually, some understanding sorts itself out, and sometimes major changes become necessary.

How It Works:

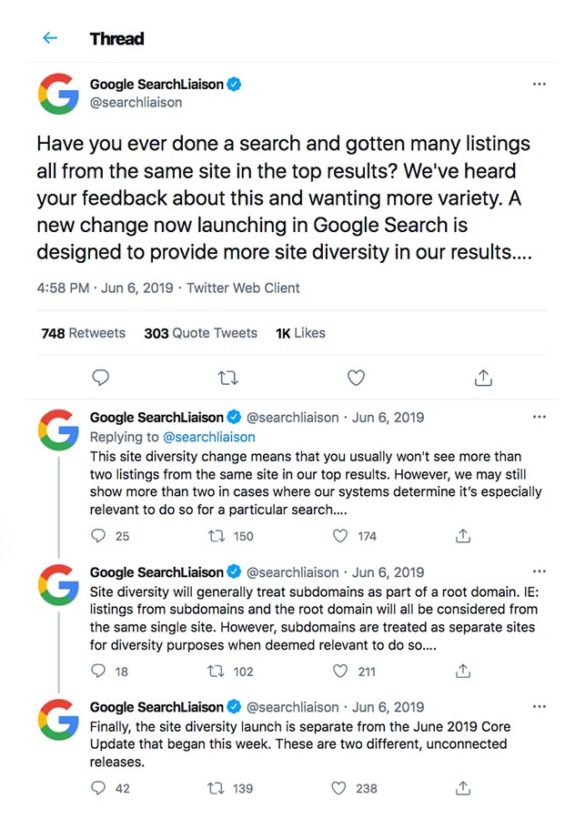

Google has gone so far as to announce when it has made a policy change or implemented a major set of updates and shifts to its algorithm, the latter generally twice a year. It publishes blogs for site developers and even runs a special Twitter account — Google SearchLiaison (@searchliaison) to put out the word — and various Google officials take compliments, comments and brickbats in their own official accounts.

A good case in point was the major change on “site diversity” launched in June 2019. The first that the world heard about the site diversity policy was going into effect was via the following thread on the Google SearchLiaison account.

Note that “diversity” in this context has nothing to do with the social sense of the word. It concerns the number of sources that the first page of your Google search will display links from. The thread explains this quite well:

Search engine optimization and its cousin, search engine marketing, the world of pay-per-click ads on search results page, can get way out in the weeds in terms of terminology and the depth of strategies. For the most part we’ll avoid that, in favor, instead, of exploring the impact that Google’s gearshift may have had on your bank or credit union’s appearance in searches and the way the shift may have subtly changed your own search results when you tap Google multiple times in a day.

And then we will show you a key trick to take back a bit of your own search freedom.

When Google Made Its Site Diversity Move

The Google search engine has many tools for adjusting search parameters that many users never explore. Most people pop in a quick search and accept what Google delivers as research gospel.

“Google is not a public library, it’s a business.”

In fact, much of what’s on the typical Google page is designed for the person who wants a quick answer to something, not for serious researchers looking to go elsewhere. And various features are designed to keep you in the Google world.

Remember, ultimately Google wants to keep you around to click on the paid links that businesses, including your bank or credit union, are sponsoring. Google is not a public library, it’s a business. And the business of getting Google to spot you and rank you highly, guided by experts, is a also a big part of its business. Some corporations spend millions on achieving Google visibility though SEO, SEM, website design and efficiency and more.

Why It Matters:

So, when Google implemented the site diversity policy, it was changing a fundamental parameter of organic search, the results that Google doesn’t get paid for (but which may be far from “free”).

A report on the new policy by Searchmetrics.com compared organic rankings for thousands of keywords before and after the change.

The research found that searches producing more than three URLs from one domain in the top ten were “effectively zero,” a decrease from 1.8%. Searches producing three URLs from one domain occurred for 3.5% of keywords, a decrease of about half. Looking at searches producing two URLS from one domain, that was up to 44.2%, a slight rise from before the change. The evaluation found that in just over half (52.3%) the searches, the top ten all came from multiple domains, an increase from the pre-shift level of 47.9%.

Other parts of the test found that in certain niche areas, Google still favored “relevance” over diversity. (Interestingly, searches for recipes were one area where multiples were still common.) The Google Twitter stream above indicated that more than two listings from the same site could still occur where relevance made it make sense.

“We still see SERPs where one site dominates, and that story didn’t change much after the update. That said, these six to ten-count SERPs are fairly rare” now, wrote Moz after the site conducted its own test. (SERP stands for “search engine results page.”) It noted that where Google appeared to have significantly violated its policy, it was the search terms that cause that. For example, naming a specific store or ecommerce site in a search can make many or all of the listings specific to it.

Read More:

How The Diversity Shift Is Impacting Financial Brands

Clearly Google has had some success in doing what it set out to do. Bertini points out that some of his financial services clients have actually benefited from the shift in policy. Now that many heavy hitters have found their presence on the first page of search results to be “rationed,” in a sense, that frees up first-page listing space for organic listings from others. Some of those companies are seeing more first-page listings than they have had in the past.

However, there are many types of searches Google users perform. For some, a more diverse mix of sources may sound good, and sound fair, but from the viewpoint of actual utility, is less useful.

Between the Lines:

Bertini points out that in some fields, for some types of queries, the site diversity policy pushes the most useful sources off the first page in favor of variety. Is the user really being given the best choices? he asks.

Further, in some ways Bertini feels that companies that have spent huge amounts developing high-quality content and tailoring their pages to fit Google’s quest for relevance are being treated unfairly. Other brands now gaining first-page exposure are essentially receiving “free money,” he says — exposure they didn’t work for.

“It’s like getting a participation trophy,” says Bertini.

Read More:

REGISTER FOR THIS FREE WEBINAR

The Truth Behind the Data: Next-Level Analysis of 2021 Consumer Banking Trends

oin this one-hour webinar to gain a deeper understanding into the sudden changes in behaviors, attitudes and expectations in the consumer banking industry revealed by Harland Clarke’s 2021 TrendWatch report.

wednesday, february 10th 2:00 PM (ET)

What Site Diversity Can Look Like In Practice

There are a couple of ways of looking at the impact of this shift.

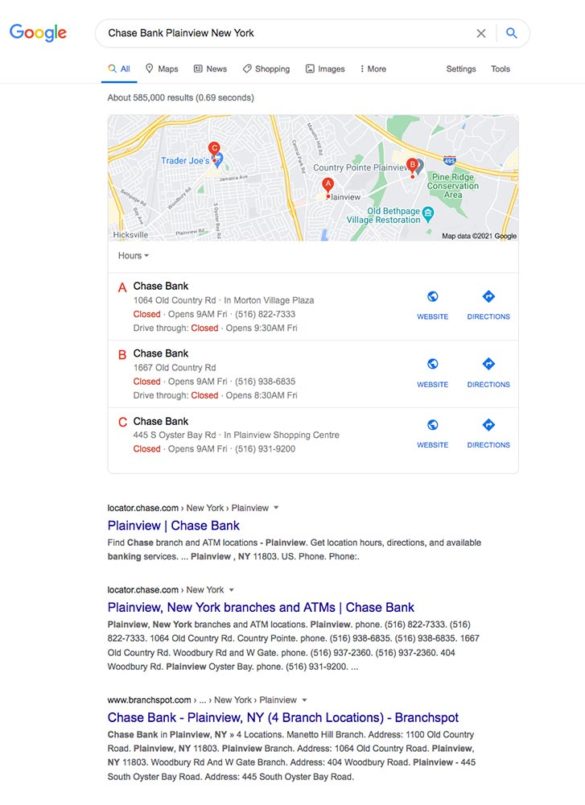

In the search below, The Financial Brand attempted to find Chase Bank branches near Plainview, New York, a NYC suburb, using Google. In the excerpt shown below, Google first produced some locations on an area map. Then two URLs appear from the Chase branch locator pages on its website. From that point on (past the point where the illustration ends), there are two listings from Branchspot, one from MyBankTracker, one from Mapquest, one from WheresMyBank, one from Bank Branch Locator, one from US Bank Locations and one from Yelp.

The first two, right from Chase’s website, are professional-looking and presumably completely accurate as to hours, etc. Some of the others are likely screenscraped and of questionable accuracy, and appear, well, schlocky. (During the height of the 2020 COVID-19 lockdown the author found that Google’s own information about branch hours for his local branch was outdated.)

But it’s a diverse mix, and in keeping with the Google policy.

That’s an institution specific search. Now let’s compare how a common search — “Best Checking Accounts” — shows up on Google and on two other search engines. One is Duck Duck Go, a site that promises not to track your history that uses Google search technology, and Bing, the Microsoft search engine. (Actual search pages run too long for readable inclusion.) Note that first-page organic search results run beyond ten on the second and third sites:

Google

• Paid ads from Capital One, TD Bank, Bethpage Federal, and the BestMoney comparison site.

• First page organic results: NerdWallet, then BankRate, Forbes, U.S. News, Business Insider, The Ascent/Motley Fool, ValuePenguin/LendingTree, CNET, The Balance, MagnifyMoney.

• Then three more paid ads from M&T Bank, Citibank and Betterment.

• No cases of multiple URLs from same site at all.

Duck Duck Go

• Paid ads for SimplyCents, Capital One and DepositsAccounts/LendingTree.

• First page organic results: Forbes, NerdWallet, Bankrate, SmartAsset.com, Motley Fool, CNET.

• Then a strip of ten videos on the subject, all from YouTube.

• Then listings from U.S. News, CNBC, I Will Teach You To Be Rich, Clark Howard, Money.com, Nerdwallet (again), Bankrate (again), The Balance, Go Banking Rates, Magnify Money, The Penny Hoarder, Money Crashers (twice in a row), CNBC, MoneySense, Kiplinger, Crediful, Millennial Money, Investopedia, Forbes (again)

• Four cases of multiple entries from same site.

Bing

• No entries were labeled as paid ads.

• Capital One, Wells Fargo, Online Banking, PenFed, DepositAccounts.com.

• A focus box of thumbnail rankings from four sites (Yahoo Finance, MoneyCrashers, Crediful and Good Financial Cents).

• Forbes, NerdWallet, Bankrate, Motley Fool.

• A strip of videos.

• Consumers Advocate, NerdWallet (again), Penfed (again), and Capital One (again)

• Three cases of multiple entries from same site (though at least one pair may reflect unlabeled ads).

A search like this, a “best of …” hunt, is the type of query that would formerly have been dominated by one of the aggregator or comparison sites, according to Bertini, by nature of what they do. NerdWallet is a site that used to get such exposure before Google’s site diversity shift. Search for other financial “bests” — savings accounts, credit cards, personal loans, business loans, card rewards — and you don’t see more than two organic listings in the first page listings for any such search on Google now. On some you see doubles, but not triples. Some search engine results pages for these queries are dominated heavily by paid listings.

Bertini has also found that some search terms that used to trigger only organic results now trigger paid listings as well. Paid listings only pay off when both seen and clicked on, and Bertini thinks Google is doing a bit of double-dipping, driving diversity and picking up money in the process.

( Read More: How Bank Comparison Sites Are Radically Altering Financial Marketing )

Strategies for Smaller Financial Institutions

While larger banks and card issuers can afford massive programs like those run by Bertini’s firm, the consultant says the cost is beyond the reach of smaller institutions that find that they aren’t getting the exposure they used to.

However, an alternative and affordable strategy can help. This requires beefing up the smaller institution’s website content. Beyond adding more and better content, he recommends diversifying the range of topics that an institution’s site covers with its content. The idea, using a fishing analogy, is to increase the number of hooks and the number of ponds where the brand can engage with more types of searches.

Another strategy is to look for keywords that can narrow a search to your institution’s locale. For example, a bank offering home loans could aim to capture keywords including mortgages, their community location and other points.

Going to keywords in volume won’t work for smaller players because large institutions can simply spend a lot more. “You have to be very strategic in your choice of keywords,” says Bertini.

In fact, Google itself has stressed to companies that the best way to meet the challenge of any of its updates is to offer the best content possible. In noting that, a blog on Seer Interactive’s site recommends asking these questions:

- Who is the intended audience for my website?

- What are they hoping to find if they visit the site?

- What are some of the factors that impact their purchase decision?

- What supporting content could be helpful for them to know?

- What do they need to see at the top, middle, and bottom stage of their search?

- What on my website could frustrate the user and force them to leave?

Strategies for Your Own Searching

While searching generally via Google can be helpful when you have no idea of where to look, sometimes you may have a pretty good idea of where you want to search, based on past experience. There is a way to tap into that using site-specific searches.

Such searches fall outside of Google’s diversity policy, by definition, and yet are quite easy to set up. Simply type in: “site: [name of the website] [what you are searching for].”

The example below, searching The Financial Brand for the terms “digital transformation,” illustrates the technique. Often these “site:” searches can be more productive than a site’s own search function. Using it for research can help improve the quality of research for marketing projects.