7 Best Information Technology Sector Dividend Stocks

In this article series, I present the top-ranked dividend growth stocks in each GICS sector.

My watch list for dividend growth stocks is Dividend Radar, a list of stocks trading on U.S. Exchanges with five or more consecutive years of higher dividend payments. Dividend Radar is updated and published every Friday and is available for download here. The latest edition (dated August 27, 2021) contains 754 stocks, 56 of which are in the Information Technology sector.

I use DVK Quality Snapshots to assess dividend growth stocks’ quality and a ranking system that sorts stocks in descending order by quality scores, using tie-breaking metrics when necessary.

Here are the previous articles in this series, in case you missed them:

The Information Technology Sector

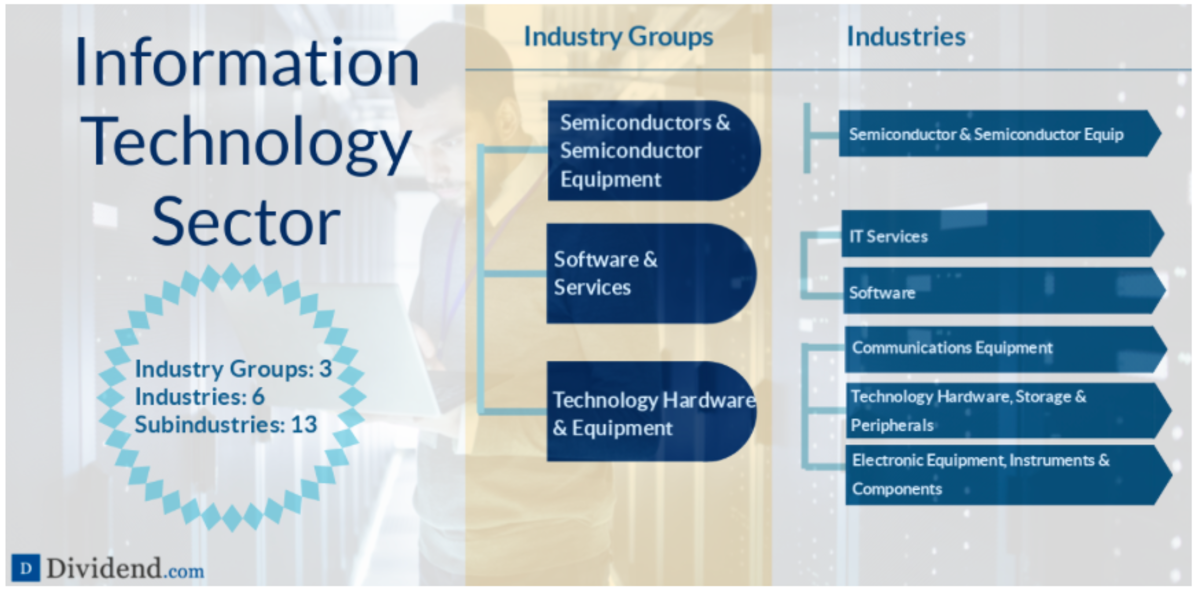

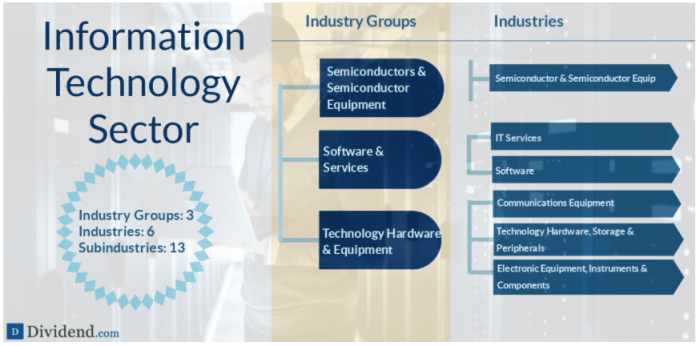

The Information Technology sector is comprised of companies that produce software, hardware, and semiconductor equipment. The three major industry groups within the Information Technology sector are Software & Services, Technology Hardware & Equipment, and Semiconductors & Semiconductor Equipment.

In 2018, the GICS was reorganized to “reflect the convergence of telecommunications, media, and select internet companies and the overlapping services rendered by these companies.” The reorganization significantly altered three sectors, Communications Services, Information Technology, and Consumer Discretionary. Communications Services (formally Telecommunications) increased from roughly 2% to 10% of the S&P 500. Information Technology reduced from approximately 26% to 20% of the S&P 500. And Consumer Discretionary decreased from about 13% to 10% of the S&P 500.

A detailed breakdown of the Information Technology sector (source: Dividend.com)

Sector and Performance Comparison

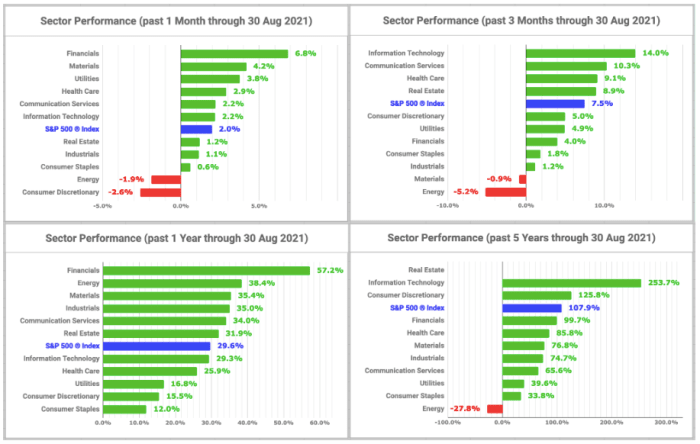

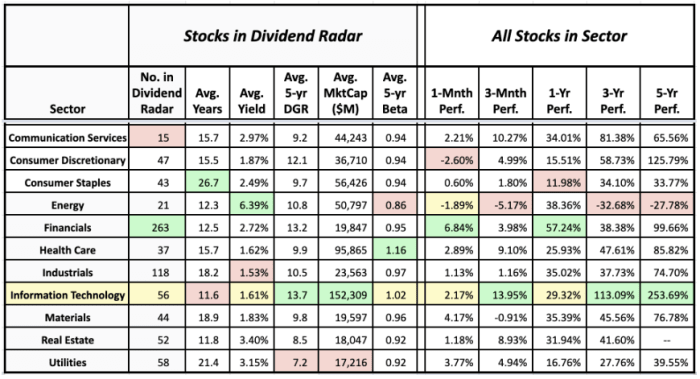

Let’s compare the sector averages and historical performance of the GICS sectors over different periods to see how the Information Technology sector compares:

Sector averages of Dividend Radar stocks and the historical performance of sectors (data sources: Dividend Radar 27 August • Fidelity Research and Google Finance 30 August)

The table is color-coded to show each column’s highest (green) and lowest (red) values. The Information Technology sector is the top-performing sector over the past 5-year, 3-year, and 3-month time frames. Furthermore, the sector has the largest average market cap (by far!) and the highest 5-year dividend growth rate [DGR] of the eleven GICS sectors. Note that the Information Technology sector has the lowest average dividend growth streak and the second-lowest average yield. Generally, dividend growth stocks in the Information Technology sector are primarily growth stocks that now happen also to pay and increase their dividends.

Sector performance charts give another interesting perspective, especially when comparing those performances to the performance of the S&P 500:

The Information Technology sector outperformed the S&P 500 in each trailing time frame except for the trailing 1-year time frame.

Quality Assessment

I use DVK Quality Snapshots to assess the quality of dividend growth stocks. The system employs five quality indicators and assigns 0-5 points to each quality indicator, for a maximum of 25 points. To rank stocks, I sort them by descending quality scores and break ties by using the following factors, in turn:

- SSD Dividend Safety Scores

- S&P Credit Ratings

- Dividend Yield

I rate stocks by quality score as Exceptional (25), Excellent (23-24), Fine (19-22), Decent (15-18), Poor (10-14), and Inferior (0-9). Investment Grade ratings have quality scores in the range of 15-25, while Speculative Grade ratings have quality scores below 15.

Top-Ranked Information Technology Sector Stocks

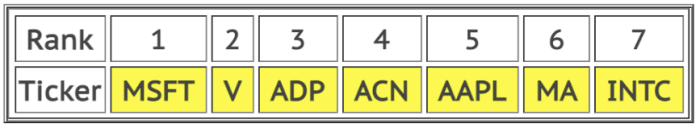

Here are the seven top-ranked dividend growth stocks in the Information Technology sector:

Note that I’m long all these stocks in my DivGro portfolio.

1. Microsoft Corporation (MSFT)

Founded in 1975 and based in Redmond, Washington, MSFT is a technology company with worldwide operations. The company’s products include operating systems, cross-device productivity applications, server applications, productivity and business solutions applications, software development tools, video games, and online advertising. MSFT also designs, manufactures, and sells several hardware devices.

2. Visa Inc. (V)

Headquartered in San Francisco, California, V operates as a payments technology company worldwide. The company facilitates commerce by transferring value and information among consumers, merchants, financial institutions, businesses, strategic partners, and government entities. V provides its services under the Visa, Visa Electron, Interlink, V PAY, and PLUS brands.

3. Automatic Data Processing, Inc. (ADP)

ADP provides technology-enabled human capital management solutions and business process outsourcing solutions. These offerings include payroll services, benefits administration, talent management, HR management, time and attendance management, insurance services, retirement services, and tax and compliance services. ADP was founded in 1949 and is headquartered in Roseland, New Jersey.

4. Accenture plc (ACN)

Founded in 1989 and is based in Dublin, Ireland, ACN provides management and technology consulting services to clients in various industries and geographic regions, including North America, Europe, and Growth Markets. ACN’s operating segments are Communications, Media & Technology; Financial Services; Health and Public Service; Products; and Resources.

5. Apple Inc. (AAPL)

Headquartered in Cupertino, California, AAPL designs, manufactures, and markets mobile communication and media devices, personal computers, and portable digital music players. The company also sells various related software, services, peripherals, networking solutions, and third-party digital content and applications. AAPL was founded in 1977.

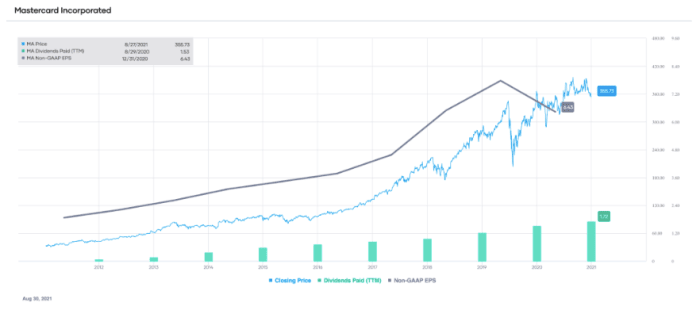

6. Mastercard Incorporated (MA)

MA, a technology company, provides transaction processing and other payment-related products and services in the United States and internationally. The company offers payment solutions and services under the MasterCard, Maestro, and Cirrus brands. MA was founded in 1966 and is headquartered in Purchase, New York.

7. Intel Corporation (INTC)

INTC designs, manufactures, and sells computer, networking, and communications platforms worldwide. The company operates through Client Computing Group, Data Center Group, Internet of Things Group, Non-Volatile Memory Solutions Group, Intel Security Group, Programmable Solutions Group, and All Other segments. INTC was founded in 1968 and is based in Santa Clara, California.

Please note that these stocks are candidates for further analysis, not recommendations.

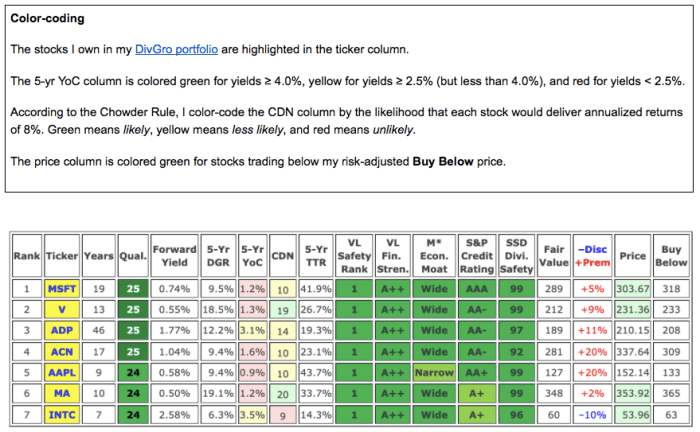

Key Metrics and Fair Value Estimates

Below, I present key metrics of interest to dividend growth investors, along with quality indicators and fair value estimates. These include the dividend increase streak (Years), the forward dividend Yield for a recent share Price, and the 5-year compound annual dividend growth rate (5-Yr DGR). The 5-year Yield on Cost (5-Yr YoC) and Chowder Number (CDN) are measures of a stock’s dividend income and future total return prospects, while the 5-year trailing total returns (5-Yr TTR) is a measure of the stock’s performance over the past five years.

I also provide the five quality indicators used in determining each stock’s quality score (Qual), as well as my Fair Value estimate to help identify stocks that trade at favorable valuations. The discount/premium column (-Disc/+Prem) shows the discount or premium of a recent share price to my fair value estimates.

To estimate fair value, I reference fair value estimates and price targets from several sources, including Morningstar and Finbox. Additionally, I estimate fair value using each stock’s 5-year average dividend yield using data from Portfolio Insight. Finally, with several estimates and targets available, I ignore the outliers (the lowest and highest values) and use the average of the median and mean of the remaining values as my fair value estimate.

Commentary

Four of the top-ranked Information Technology sector stocks are rated Exceptional, and three are rated Excellent.

INTC is the only stock that is discounted to my fair value estimate. Still, three other stocks are trading below my risk-adjusted Buy Below prices: MA, MSFT, and V. Additionally, ADP is trading just above my Buy Below price, so I suggest putting the stock on your watchlist.

It is fascinating to compare the relative performances of these stocks.

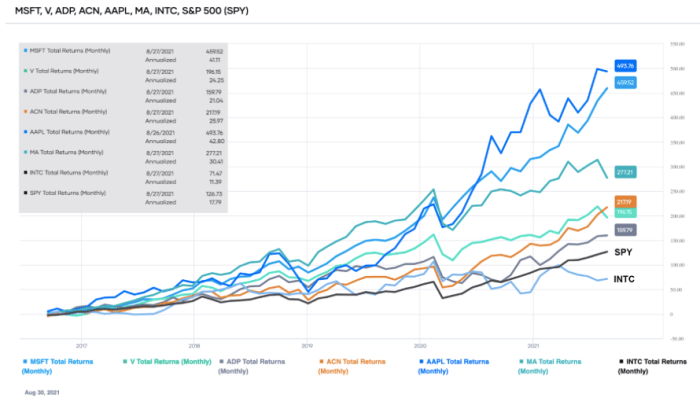

Consider the following chart showing the total returns (price appreciation and dividends) of the top-ranked Information Technology sector stocks over the trailing 5-year time frame:

Comparison of the total returns of the top-ranked Information Technology sector stocks over the past ten years (source: Portfolio-Insight.com)

Except for one stock, INTC, the stocks easily outperformed the SPDR S&P 500 ETF (SPY), an ETF designed to track the 500 companies in the S&P 500 index. The top-performing stocks over this time frame are AAPL and MSFT, with total returns of 493% and 460%, respectively. Those are spectacular annualized returns of 43% and 41%, respectively!

Investors looking for dividend income only have one option among these stocks, INTC, which currently yields a respectable 2.58%. Compare that with INTC’s 5-year average yield of 2.55%, and it’s presenting a good buy opportunity here. One word of caution would be estimated earnings, which are being projected to decline in FY 2021 and FY 2022:

INTC’s non-GAAP EPS history and estimates for FY 2021 and FY 2022 (source: Portfolio-Insight.com)

According to Simply Safe Dividends, INTC’s earnings payout ratio of 26% is “edging high for semiconductor firms.” Future dividend increases may be tempered if earnings continue to decline.

For investors looking for total returns rather than dividend income, MA presents the best opportunity, in my view. The stock has the highest 5-year DGR of 19.1% and is trading just 2% above my fair value estimate. Given the stock’s Excellent rating, though, I’d be willing to pay up to $365 per share.

MA has a stellar dividend and earnings growth history and a very low payout ratio of only 25%:

Non-GAAP EPS are projected to increase by 27% in FY 2021 and by 30% in FY 2022, so the small decline of 6% in FY 2020 shouldn’t concern growth investors too much.

Concluding Remarks

This article presented the seven top-ranked dividend growth stocks in the Information Technology sector. Based on my rating system that maps from DVK Quality Snapshots to quality scores, four stocks are rated Exceptional, and three stocks are rated Excellent. Four stocks trade below my risk-adjusted Buy Below prices, but only INTC is available at a discounted valuation.

INTC is discounted and offers a good investment opportunity for income seekers, while MA is my choice for investors looking for strong total returns, mainly through stock price appreciation and fast dividend growth.

Thanks for reading!

Next time, we’ll look at the best Materials sector stocks.

Thanks for reading!

You can follow me here:

- Twitter: @div_gro

- Facebook: @FerdiS.DivGro

I’d be happy to answer any questions you may have!